June is a pivotal month. The US debt-ceiling

political drama cast a pall over sentiment even if it did not prevent the

dollar from rallying or the S&P 500 and NASDAQ from setting new highs for

the year. It is as if the two political parties in the US are playing a game of chicken

and daring the other side to capitulate. Both sides are incentivized to take to

the brink to convince their constituents that they secured the best deal

possible. No side seems to really want to abolish the ceiling because it has

proven to be an effective lever for the opposition to win concessions over the

years. Still, a higher debt ceiling and some reduction in spending in the FY24

budget are the middle ground.

Many think that this time is different. The partisanship, they say, is so

extreme that a default is possible. They can point to severe distortions in

the T-bill market and the elevated prices to insure against a US default

(credit default swaps). Neither side can be sure it will not be blamed for a default's expected and unexpected consequences. The risk of playing

chicken is that neither driver swerves at the last minute. There are only downside scenarios in a default situation, even if it lasts for a short

term and no bond payment is missed. On the other side of the debt ceiling, bill

issuance will rise, and the Treasury will rebuild its account held at the

Federal Reserve. This could drive up short-term rates and reduce liquidity.

In addition

to fiscal policy, a monetary policy drama is also playing out. The

Federal Reserve began hiking rates in March 2022, and at the May meeting, Chair

Powell indicated that a pause was possible. Although he made it clear that it

was not a commitment, the markets saw the quarter-point move as the last. However, a combination of stronger economic data, sticky price pressures, and some hawkish comments saw the pendulum of expectation swing toward a hike at the June 13-14 meeting (60%). Moreover effective Fed funds rate (weighted average) is about 5.08%, and the

market-implied year-end effective rate is around 5.0%. It was near 4% as recently as May 4, which illustrates the extent of the interest rate adjustment. Even if the Fed

stands pat in June, we expect Chair Powell to validate market expectations that

another hike will likely be forthcoming (July).

There

continue to be worrisome economic signs in the US, including the inverted yield

curves, the precipitous decline in the index of Leading Economic Indicators, an

outright contraction in M2 money supply, the tightening of lending standards,

and a reduction in credit demand. However, at the same time, despite some

slowing, the labor market is strong, with an improvement in prime working-age

participation. Consumption rose by 3.7% in Q1 and appears off to a good start

in Q2, with stronger auto and retail sales in April. Supply chain disruptions

have improved, shipping costs have receded and are back within the 2019

range. The Atlanta Fed's GDP tracker sees growth of 1.9% in Q2, near the Fed's

non-inflation speed limit of 1.8% and though a bit faster than Q1 (1.3%).

Another

drama that has unfolded is the stress on US banks. Banks with increasing low-yielding assets did not offer competitive interest rates with

prime money market funds (only invest in US government/agency paper) and the US

bill market itself. While the banking system lost deposits, several of the

largest banks reported increased net interest income. However, even after

the deposits at small banks stabilized, pressure continued on their shares.

That selling pressure seemed to be exhausting itself. June may be a pivotal

period for this drama too. Still, many regional banks are exposed to the

commercial real estate market, which is under pressure.

Europe

avoided a tragic winter energy crisis, but the drama is that inflation is

providing sticky, and the regional economy looks as if it stalled at the end of

Q1. Indeed, revisions show that the German economy contracted 0.3% in Q1

after a 0.5% contraction in Q4 22. The eurozone and UK economies expanded by

0.1% quarter-over-quarter in the year's first three months. The eurozone

and UK appear stuck in low gear, but the market is confident of quarter-point

hikes by the European Central Bank and the Bank of England in June.

Japan has a

drama of its own. The Bank of Japan is under new management, but it turns out

that its extraordinary policy was not simply a function of former Governor

Kuroda's idiosyncrasies. Several surveys of market participants saw June/July

as the likely timing of an adjustment in the policy settings. However, Governor

Ueda's call for patience suggests little sense of urgency, and some

expectations are being pushed out to the end of Q3. The recent history of

lifting interest rates or currency caps suggests a dramatic market response

even under the best circumstances. Still, the best time to

adjust the cap on the 10-year bond is when it is not being challenged. The BOJ

is the last of the central banks with a negative policy rate. This is

increasingly difficult to justify. The swaps market is not pricing in a

positive rate until early in the second half of the fiscal year, which begins

on October 1.

Geopolitics

are always dramatic. It seems clear that US officials, including President

Biden, had recognized that bringing NATO to Russia's border was provocative.

After relatively mild responses to Russia's invasion of Georgia and the taking

of Crimea, the reaction to last year's invasion of Ukraine is a big shock to nearly

everyone. The US has led a coalition that has stymied Russia by arming Ukraine with weapons, training, money, and intelligence.

Initially, China appeared to be a net loser of Russia's invasion. NATO is stronger.

US leadership was again demonstrated. Parallels between Ukraine and Taiwan were

drawn ubiquitously. There has been a rapprochement between South Korea and Japan,

and both are boosting military spending. The US secured new bases in the

Philippines. However, China is finding its own opportunities.

Just as the

US thinks Russia is in a quagmire, China may think it has the US in one.

President Biden has cast the defense of Ukraine as the frontline of the battle

between democracy and authoritarianism. However, American public support is not

particularly strong, and continued unlimited support may become a political

issue in next year's election. Meanwhile, China has moved into the vacuum

created by the US and European sanctions. China has secured Russia into its

sphere of influence, which Beijing could not have dreamed of before the

invasion. Using the swap lines with the PBOC has allowed several developing countries to pay for imports from China. It is similar to

producer-financed sales in market economies. China is exploiting niches that the US and Europe have created purposefully or otherwise. Even taking into

account the problematic debt that has arisen from the Belt Road Initiative, it

is creating and solidifying a trade network that may be of increasing

importance to China going forward.

The sharp

rise in interest rates in May made for a challenging time for risk assets.

Equity indices for developed and emerging market economies fell in May, but

there were notable exceptions. The S&P 500 and NASDAQ rallied to new highs

for the year. Germany's DAX and French CAC set record highs, while Japan's

Topix and Nikkei reached their best levels since 1990. Among emerging markets, Brazil (~6%), Chile (~4%), Poland (~3%), Hungary (~6%), Taiwan (~6%), and

South Korea (~2.3%) are notable exceptions.

Emerging

market currencies mostly fell in May. The JP Morgan Emerging Market Currency

Index fell by 1.3% after slipping about 0.35% in April. It is the first

back-to-back monthly decline since a four-month drop in June through September last

year. It is essentially flat on the year. Latin American currencies continue to

stand out. They accounted for four of the top five emerging market currencies

in May: Colombia (~5.1%), Mexico (~1.9%), Peruvian sol (~1.0%), and Chile (~0.4%). The South Korean won was the exception; its 1% gain put it in

the top five.

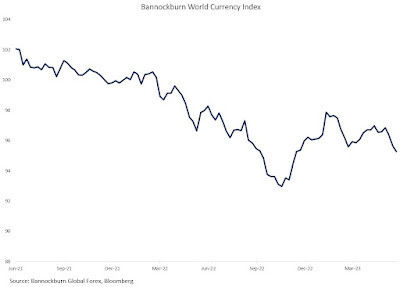

BWCI bottomed early last November near

92.80, confirming the dollar's top. It rallied into early February to peak near

98.15. The decline into March retraced about half of the rally, while the

year's low set in late May (~95.25) is within 0.75% of a critical area. This is

consistent with our base case that while there may be some scope for additional

dollar gains, it looks limited as the interest rate adjustment also appears to be complete or nearly so. In our analysis of the different currencies below, we

have tried to quantify where the base case breaks down.

Dollar: The

interest rate adjustment, where the market converges to the Fed rather than vice versa, and the knock-on effect of supporting the US dollar

unfolding broadly aligns with the view sketched here last month. The two-year

yield rose by around 65 bp in May to about 4.65%, the highest since mid-March.

The year-end policy rate is near 5% rather than 4.5% at the end of April. We

suspect that the interest rate adjustment is nearly complete, helped by what

will likely be slower economic growth after the rebound in Q2. The growth

profile may be almost a mirror image of 2022. Then, the economy contracted in

H1 and rebounded in H2. This year, the economy appears to have grown near trend

in H1 and looks set to slow in H2. The odds of a Fed hike on June 14 were around 65% before the Memorial Day holiday (May 29), and it is fully discounted for the July meeting. The Fed's economic projections

will be updated. The 0.4% median forecast for growth at the March meeting seems

too low and will likely be increased. At the same time, the 4.5% year-end

unemployment rate seems too high. Unemployment was at 3.4% in April. The median forecast bring

it down a bit. The debt ceiling wrangling does not put the US in the best

light, but barring an actual default, it will not have lasting impact. Outside

of the T-bill market and the credit-default swaps, investors took this peculiar

American political tradition in stride. Our working hypothesis has been that

the dollar was going to "correct" the selloff that began in early

March as the bank stress struck. In the last full week of May, the Dollar Index

exceeded the retracement target near 104.00. A move above the 104.70 area would

suggest potential back toward the 200-day moving average (~105.75) and the

March high near 106.00. A break below the 103.00 area would suggest a high may

be in place.

Euro: Eurozone

rates could not keep pace with the dramatic swing higher in the US. Germany's

two-year yield rose by about 20 bp in May, less than half what the US

experienced. Yet, the euro's roughly 2.75% decline in May was not only a dollar

story. The proverbial bloom came off the rose. The fact that with a combination

of preparedness and good luck (low oil/gas prices and a mild winter), the

eurozone avoided an energy crisis. The positive economic impulses carried into

February, but by the end of March, economic growth stalled, or worse. After a

second look, Germany contracted by 0.3% in Q1 (initially estimated at zero)

after a 0.5% decline in economic output in Q4 22. The European Central Bank

started later than most G10 countries to begin adjusting monetary policy, and

institutional rigidities may make price pressures more resistant. The ECB meets

on June 15 and the market is confident of a quarter-point hike that would lift

the deposit rate to 3.50%. The staff will also update its economic forecasts. The

terminal rate is seen at 3.75% in late Q3 or early Q4. On June 28, European

banks are due to pay back the ECB around 475 bln euros of loans (Targeted

Long-Term Refinancing Operations). They account for around 6% of the assets on

the ECB's balance sheet and almost 45% of the outstanding TLTRO loans. The

sheer magnitude of the maturity could prove disruptive, and some banks may look

to find replacement funding. The ECB's balance sheet has been reduced by about

3% this year and the repayment of the TLTRO would do more with a single blow. Recall

that end of the of last year, European banks returned almost 492 bln euros. The

euro overshot our $1.0735 objective. We suspect the euro's downside correction

is nearly over, but a break of the $1.0680 area may signal losses back to the

March low near $1.05.

(May 26, indicative closing prices, previous in parentheses)

Spot: $1.0725 ($1.1020)

Median Bloomberg One-month Forecast $1.0890 ($1.0960)

One-month forward

$1.0740 ($1.1040) One-month

implied vol 6.8% (7.5%)

Japanese

Yen: Rising US rates seemed to have dragged the greenback higher

against the Japanese yen. The gains in May took it a little through JPY140, the

highest level since the end of November, and beyond the halfway marker of the

drop from last October's high near JPY152. Just as there may be some more room

for the US 10-year yield to climb above 3.80%, there may be scope for the

dollar to rise further against the yen. The next important chart area is around

JPY142.50. Underlying price pressures in Japan continue to rise, and the

weakness of the yen only adds to the pressure on the BOJ to adjust its monetary

settings. The economy expanded by 0.4% in Q1, well above expectations, and in late

May, the government upgraded its monthly economic assessment for the first time

in ten months. Several surveys found many see a window of opportunity in June

or July for the BOJ to adjust monetary policy. Most of the speculation has

focused on yield-curve-control (YCC), which caps the 10-year yield at

0.50%. We do not think it will be abandoned entirely, and targeting a

shorter-dated yield may be considered. It could lift the overnight target rate

to zero from -0.10%. If experience is any guide, when it comes, the timing will

likely surprise, and it is bound to be disruptive. It will likely weaken the

correlation between the exchange rate and US yields. Lastly, there is much talk

about a snap election in Japan over the summer as Prime Minister Kishida looks

to secure his mandate and support for him, and the cabinet has risen recently.

He hosted the G7 summit and brandished leadership. Politically, it may be the

most opportune time before September 2024 LDP leadership contest, while the

economy is relatively strong, the stock market is near 30-year highs, and he is

perceived favorably.

Spot: JPY140.60 (JPY136.30)

Median Bloomberg One-month

Forecast JPY133.45 (JPY133.05)

One-month forward

JPY139.95 (JPY135.75) One-month implied vol 10.8% (9.5%)

British

Pound: May was a month of two halves for sterling. In the first half of

the month, it extended its recovery off the for the year set on March 8 near

$1.1800. Sterling peaked on May 10 at around $1.2680, its best level since June

2022 and an impressive recovery from last September's record low of about $1.0350.

In the second half of May, sterling trended lower and fell back to almost $1.2300.

Our base case is that the move is nearly over, with the $1.2240 area likely to

hold back steeper losses. However, if this area goes, another cent decline is

possible in this benign view. Stubborn inflation and a firm labor market have

produced a dramatic interest rate adjustment in the UK that may lend sterling

support. The year-end policy rate is seen above 5.50%. This is a 70 bp increase

since the middle of May. The two-year and 10-year Gilt yields were mostly flat

in the first half of May and soared around 75 bp in the second half. The

10-year breakeven (the difference between the inflation-protected security and

the conventional bond) rose a little more than 10 bp in the last couple of

weeks. The Bank of England meets on June 22, the day after the May CPI is

published. The market is debating whether a 25 bp or 50 bp hike will be

delivered. We lean toward the smaller move unless the incoming data surprises.

Spot:

$1.2345 ($1.2565)

Median Bloomberg One-month

Forecast $1.2400 ($1.2480)

One-month forward

$1.2355 ($1.2575) One-month implied vol 8.0% (7.6%)

Canadian

Dollar: The Canadian dollar fell by about 0.60% against the US dollar in

May, making it the best performer in the G10. The Swiss franc was second with

twice the loss. After testing April's low (~CAD1.3300) in early May, the US

dollar recovered and set the month's high (~CAD1.3650) in late May. While interest

rate developments can help explain the broader gains in the greenback, the

exchange rate with Canada seems to be more sensitive lately to the general risk

environment (for which we use the S&P 500 as a proxy) and oil. The price of

July WTI collapsed from around $76.60 at the end of April to a little below $64

on May 4. It worked its way back up to almost $75 on May 24 before stalling.

There has been a significant interest rate adjustment in Canada over the last

few weeks. The 2-year yield rose by nearly 60 bp. At the end of April, the

market was pricing in a cut before the end of the year and now it is fully

discounting a hike. The Bank of Canada meets on June 6. The swaps market has a 33% chance of a hike and a hike is fully discounted by the end of Q3. At the end of April, a June hike was

seen as less than a 10% risk. A move above CAD1.3700 could signal a return to

this year's high set in March near CAD1.3860.

Spot: CAD1.3615 (CAD 1.3550)

Median Bloomberg One-month

Forecast CAD1.3405 (CAD1.3475)

One-month forward CAD1.3605 (CAD1.3540) One-month implied vol 6.0% (5.8%)

Australian

Dollar: The surprising quarter-point hike by the Reserve Bank of

Australia saw the Australian dollar fray the upper end of the $0.6600-$0.6800

range that has dominated since late February. Disappointing employment data,

concerns about the pace of China's recovery, and the sharp selloff of the New

Zealand dollar (following the central bank's hike that could be the last one)

weighed on the Australian dollar. It recorded the lows for the year slightly

below $0.6500. There is little meaningful chart support ahead of $0.6400, but a

move back above $0.6600 would suggest a low is in place. The squeeze on households can e expected to increase in the coming months as mortgages taken on in the early days of the pandemic will begin to float at higher rates. The RBA meets on June

6 and there seems to be little chance of a hike, though the market is not

convinced that the tightening cycle is finished. A small hike (~15 bp) is

possible in Q3. The first estimate of Q1 GDP is due the day after the RBA meeting, but we assume officials will have some inkling. Although there is some talk of the risk of a contraction, it likely grew slowly.

Spot:

$0.6515 ($0.6615)

Median Bloomberg One-month

Forecast $0.6785 ($0.6710)

One-month forward

$0.6525 ($0.6625) One-month implied vol

10.3% (10.1%)

Mexican

Peso: Between the central bank's pause and the broader dollar's

strength, the peso fell on profit-taking after it reached a new seven-year

high in the middle of May. However, the considerations that have driven it

higher remain intact, suggesting its high is not in place. Those forces include

the attractive carry (11.25% policy rate) and a relatively low vol currency

(especially among the high-yielders), the near-shoring and friend-shoring that

has seen portfolio and direct investment inflows, and, partly related, the

healthy international position, with record exports and stronger worker

remittances. The dollar fell to almost MXN17.42 in mid-May and its bounce

stalled near MXN18.00. A break of the MXN17.60 area may signal a retest of the

lows, but in the medium term, there is potential toward MXN17.00. While

Mexico's government has not facilitated an investor-friendly environment, the

market appears to be rewarding the strong and independent central bank and

Supreme Court.

Spot:

MXN17.6250 (MXN18.00)

Median

Bloomberg One-Month Forecast MXN18.1675 (MXN18.26)

Chinese Yuan: China is notoriously opaque in terms of information and economic data. The market's general sense is that Beijing will take more measures to ensure growth stays on track with weak price impulses. The low CPI (0.3% year-over-year in April) is partly a function of weak demand, but the overcapacity in some sectors, such as autos, also is deflationary. A reduction in required reserves is possible. The expected policy divergence is more important to investors than modest swings in China's large and persistent trade surplus. As the dollar moved to new highs for the year in mid-May above CNY7.00, PBOC officials expressed concern about the volatility and one-way market. And the yuan's losses have been extended further. The next important chart area is near CNY7.10. Still, the yuan remains correlated with the euro and yen, and their weakness helped drag the yuan to new lows for the year. Chinese assets may not be particularly attractive to foreign asset managers, but the yuan is being used more to settle trade (and not just with Russia and Hong Kong). Its share of the SWIFT messages rose to 2.3% in April, the most in six months.

Spot: CNY7.0645 (CNY6.9185)

Median Bloomberg One-month Forecast CNY6.8625 (CNY6.8570)

One-month forward CNY7.0500 (CNY6.9060) One-month implied vol 5.4% (4.9%)

Reviewed by Marc Chandler

on

May 27, 2023

Rating:

Reviewed by Marc Chandler

on

May 27, 2023

Rating: